Every trader enters the market to make money. Even if you study the market and keep a close eye on the charts, you can still lose money on your trades. Why? Most of the time, it comes down to a battle between emotion and logic, with logic being more technical and personal. The market is …

Month: May 2025

Everyone wants to achieve financial independence, but few understand that the secret to wealth lies in our daily lives. By regularly adjusting the way we invest, save, and spend, we can dramatically change our financial future. The first step to growing your wealth is to change your habits, whether it’s saving more or paying off …

While we think we make logical financial decisions, the reality is that our brains often play tricks on us when it comes to assessing risk. Fear, past experiences, and cognitive biases can cloud our perspective, leading to costly mistakes like panic selling during a market downturn or abandoning investments altogether. The first step to making …

Many of us think we have our finances under control, but there are hidden holes—financial blind spots—that can quietly ruin our wealth in the long run. People often overlook these areas, such as poor budgeting, uncontrolled contributions, inadequate insurance, or unrealistic retirement planning. If you want a healthy financial future, you need to fix your …

Stock market crashes are like emotional earthquakes that erode confidence, destroy wealth, and test even the most experienced investors. When the stock market drops and red warning signs appear on your screen, the first thing you might think of is fear. The truth is, most people panic, but the best investors stay calm. Why? Because …

Tracking your monthly expenses is essential for financial control. Budgeting and saving is nearly impossible without knowing where your money is going. Uncontrolled and unnecessary spending is often the reason why many people spend more than they earn, even when their income is stable. By tracking every dollar spent each month, you gain insight into …

With so many decisions to make in today’s fast-paced world, it’s no surprise that many of us find ourselves mentally exhausted from constantly managing our finances. The money decisions never end. You have to decide which expenses to pay first, when to save, whether to invest, and how to budget. These decisions permeate every aspect …

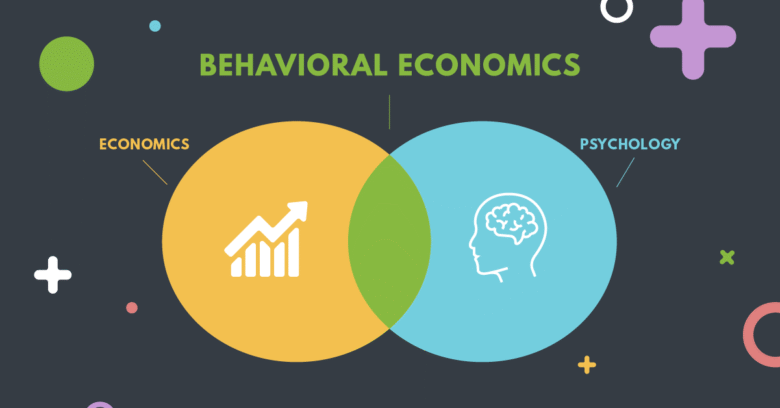

While we like to believe that we use reason and logic when making financial decisions, the reality is far more fascinating. Behavioral economics explains how our brains make predictable financial mistakes, take shortcuts, and fall into emotional traps—often without us even knowing it. They influence every penny we save or spend, from irrational consumption to …

One of the best ways to manage your money and secure your financial future is to create a budget. A personal budget can help you track your income, understand your expenses, and stay within your means. It can prevent financial stress and help you achieve your goals. Whether you’re saving for a vacation, paying off …

It’s easy to fall into the habit of following the crowd, both personally and in investing. When you see a lot of people buying a popular stock or the latest cryptocurrency, it seems safe to join the crowd. After all, how can so many people make mistakes? But the hard truth is that following the …